Media Outlet: Sharetisfy

Friday, 08 April 2022

REX INDUSTRY BHD (9946) - A HIGH CONVICTION TRADE SETUP WITH GOOD PRECEDENT

BACKGROUND

Rex Industry Berhad (Rex) was founded in Nov 1993 and listed on the Bursa Malaysia on 29 Nov 1995. The company is involved in the manufacturing of F&B products, specialising in canned food, confectionery goods and flavoured drinks.

Rex undertook a 3-year turnaround plan in 2018, which was completed in 2021 and managed to turn the business back into profitability. The company has remained profitable for the last 6 consecutive financial quarters. Profits are expected to get a boost from the recovery in the HORECA channel as well as the rebound in domestic demand as the country transition into the endemic phase.

The fundamentals of Rex has been well covered by CIMB Research when they initiated a Non Rated Note on 9 November 2021 when the price was trading at RM0.255. Today, we will examine a potentially profitable trade setup by participating in the recently approved rights issue exercise.

PRICE CHART

After hitting a 3 year high of RM0.30 on 8 November 2021, Rex has been on a steady decline, touching a low of RM0.185 on 8 March 2022. It has since started regaining some upward momentum and has just broken the downtrend line on 6 April 2022, when it closed above the RM0.21 pivot point.

Initial resistance can be found at RM0.27, and if broken convincingly could see a retest of the RM0.30 level.

BUSINESS EXPANSION AND PROPOSED RIGHTS ISSUE EXERCISE

Rex has just received approval from Bursa Malaysia on 4 April 2022 for the proposed rights issue with warrants. The rights issue will comprise of 1 rights share for every 3 existing shares, with 1 free warrant for every 3 rights shares subscribed. The indicative issue price per Rights share has been set at RM0.10 but the entitlement date has yet to be announced. The whole exercise is expected to be completed by the end of 2Q 2022.

The proceeds from the rights issue will be used for business expansion plans within 18 months and working capital for the next 12 months. Within the next three years, Rex aims to double its revenue from RM160 million in FY21 by introducing new products and expanding its client base and partners with more large scale retailers.

PROFITABLE TRADE SETUP FROM RIGHTS ISSUE EXERCISE

- WILL HISTORY REPEAT ITSELF?

Rex had previously completed a 1 for 1 rights issue back in Dec 2020, which raised about RM19 million. The funds were mainly used to pare down its borrowings and for working capital. If one had participated in this exercise, what would have been the returns?

Investors who bought during the entitlement period would have paid an adjusted ex price of around RM0.17 in Nov 2020. The price would eventually move to a high of RM0.28 on 6 Jan 2021! That is a considerable 64% in just 2 months!

Despite the strong performance in Rex for 2021, there had been no declaration of any Company Insider selling. From Bursa Malaysia filings, it was reported that the Managing Director, Darmendran Kunaretnam through his holding company, Daiman Taipan Sdn Bhd (DTSB) had purchased a total of 16 million shares from the open market with prices ranging from RM0.23 to RM0.25 since 31 Dec 2020. Together with DTSB, Darmendran collectively owns around 39% of Rex as per the latest annual report.

- OTHER PROFITABLE RIGHTS ISSUE EXERCISES

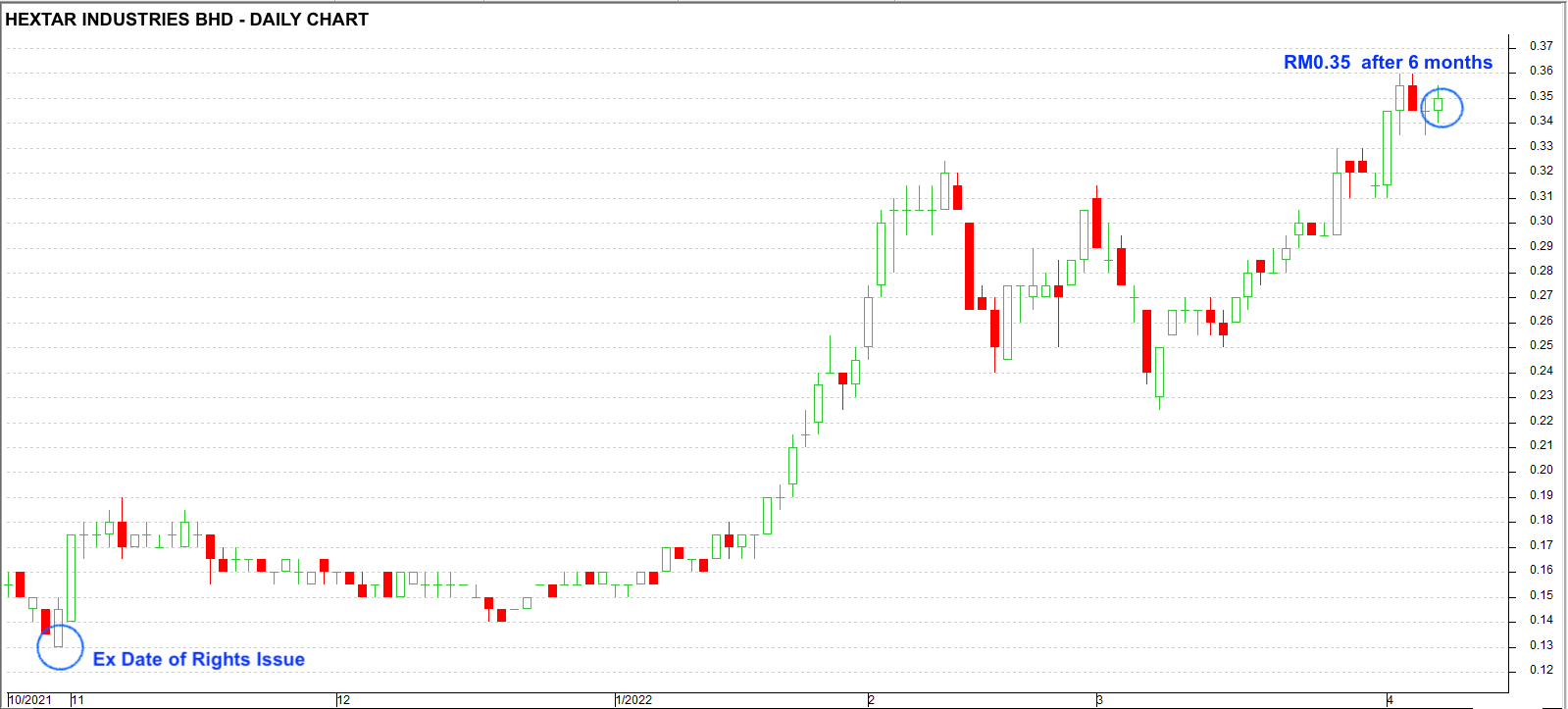

HEXTAR INDUSTRIES

Hextar Industries (Hexind) undertook a 5-for-1 rights issue in October 2021 at an exercise price of RM0.12 per share. Investors who went through the exercise and are still holding the shares today would have tripled their money!

Dato Eddie Ong and his family collectively owned 47% of Hexind after the completion of the rights issue exercise.

TAFI INDUSTRIES BHD

Tafi Industries Bhd (Tafi) had a 3 for 5 rights issue in March 2021. The bonus adjusted price in March 2021 was RM0.21. By September 2021 the price had rocketed to a high of RM0.97 for a staggering gain of 460%!

The major shareholder of Tafi, Dato Sri Andrew Lim had been actively accumulating shares 3 months prior to the entitlement date of the rights issue exercise.

CONCLUSION

We have found that corporate exercises like rights issues and warrant conversion (ie. Dancomech Bhd which was covered recently) can be very rewarding trade setups. The key is to pick companies with good fundamentals and align our interest with the company insiders who have large equity commitment at stake.

Source link: https://www.sharetisfy.com/2022/04/rex-industry-bhd-9946-high-conviction.html